The Profit First Quiz Edition: Mastering the Management of Your Business Financials

Many new and seasoned business owners still struggle to understand and manage their finances. Financial success isn’t just about making money; it’s about managing it wisely, and that involves understanding the key concepts that revolve around the finances in business situations. Profit First Nation’s latest episode, ep. 150 is a special Q&A session that involves giving the audience a series of quiz questions and providing valuable answers that are helpful for business owners to know and apply.

As we start this quiz, we’re going to look at important questions about actual income, how you pay yourself, tax strategies, and more. Each question is made to help you better understand Profit First ideas. This will give you useful insights to change how you handle money in your business.

Understand the Meaning of Real Revenue

Question 1: Real revenue is:

- The same as gross profit.

- Total revenue minus the total cost of goods sold.

- Total revenue minus materials and subcontractors.

Answer: C – Total revenue minus materials and subcontractors

For many businesses, “real revenue” is not necessarily the same as total sales. Since Profit First is a cash management system, allocations are done off of real revenue which requires you to deduct direct costs like materials and subcontractor expenses from total sales. Real revenue represents the money available for your business after accounting for the costs directly associated with those sales. Your real revenue number is then used as the foundation for making strategic financial allocations, a crucial step in the Profit First system.

NOTE: For some businesses that don’t have COGS (materials or subcontractor expenses) associated to total sales revenue – then for these businesses, their total revenue and real revenue are the same number because there are no direct expenses to deduct.

Owner’s Compensation and Payroll

Question 2: Business owners who take a salary as part of their company’s Payroll don’t need an Owner’s Comp account.

- True

- False

Answer: B – False

If you pay yourself through the company’s payroll system, it is essential to maintain an Owner’s Compensation (Owner’s Comp) account. On allocation days, funds should be distributed accordingly – Profit first, then Owner’s Pay, then Tax, and finally Operating Expenses.

After allocating funds to the Owner’s Pay account, there is a secondary step where a sweep occurs from the Owner’s Comp account. This sweep can be directed towards operating expenses if the payroll comes directly out of operating expenses. Alternatively, if the business has a separate payroll account, the Owner’s Comp dollars are swept into that account, and the payroll company processes disbursements from there.

Smart Tax Strategies

Question 3: If you want to pay as little as possible in taxes, you should:

- Run up expenses by the end of the tax year in order to reduce your taxable income.

- Run your business as profitably as possible and work with your tax advisor to find ways to reduce your tax liability that don’t include running up expenses.

- Have your spouse increase the amount withheld from their paycheck.

Answer: B – Run your business as profitably as possible and work with your tax advisor to find ways to reduce your tax liability that don’t include running up expenses.

If you want to pay as little as possible in taxes, the key is to run your business as profitably as possible. This involves collaborating with your tax advisor to explore strategies that go beyond merely running up expenses by the end of the tax year.

Some CPAs encourage businesses to spend excessively to minimize tax liability. However, Profit First opposes this strategy because it leads to unnecessary spending on items the business doesn’t need. So, instead of getting tax advisors whose advice is for you to keep spending, opt to choose Profit First professional accountant, bookkeeper, or coach. They will work with you on your taxes and leverage other strategies.

Handling Sales Tax

Question 4: If you collect sales tax in your business, you should:

- Pay them from the OpEx account.

- Pay them from the tax account.

- Open a separate bank account for sales tax.

Answer: C – Open a separate bank account for sales tax.

If you collect sales tax in your business, opening a separate bank account specifically for sales taxes is essential. Many people are confused with the term “tax account” used for Profit First allocations. The Profit First tax account for allocations is designed to exclusively benefit the business owner; it provides a means to allocate money to cover various tax liabilities associated with being the owner of the business. It includes estimated quarterly taxes and can be used to reimburse the owner for taxes paid on payroll.

However, a tax account is not intended for handling sales or other payroll taxes. For sales tax, a separate bank sales tax account should be established.

NOTE: Sales tax should come off the top and out of the income account BEFORE you do your allocations – like you deduct materials and subcontractor expenses aka COGS before you net your real revenue number from which serve as the basis for your allocations to profit, owner’s pay, tax, and operating expenses

Your Timing to Implementing Profit First

Question 5: When you implement Profit First in your business, what should you do with the money in your existing bank account?

- Calculate the retroactive Profit First allocations and allocate the money to your new Profit First accounts.

- Leave the money in your existing bank account, except for the funds needed to open your new Profit First accounts.

- Use it to pay debt and start building your cash reserves with your next deposit.

Answer: B – Leave the money in your existing bank account, except for the funds needed to open your new Profit First accounts

When introducing Profit First into your business and already having funds in your existing bank account, the recommended approach is to leave that money in your current account. The exception is using the necessary funds to open your new Profit First accounts. This may involve meeting the minimum deposit requirements imposed by the bank for each Profit First account (Profit, Owner’s Pay, Tax, Operating Expenses). Typically minimum opening deposits can vary, ranging from $10 to $500.

Leveraging the Snowball Effect in Paying Debts

Question 6: In Profit First, we address debt by:

- Paying off the loan with the highest interest rate first.

- Filing bankruptcy.

- Using a debt snowball or snowball effect.

Answer: C – Using a debt snowball or snowball effect.

In Profit First, the strategy for handling business debt involves employing a debt snowball or snowball effect coined by Dave Ramsey.

Here is how the snowball effect works:

- Look at your various business debts and identify the debt with the lowest balance.

- At the end of each quarter, review the balance in your Profit Hold Account. Take 99 percent of this balance and allocate it towards the principal on your identified lowest debt balance.

- Continue this process quarterly. The idea is to start small by paying off the smallest debt first, then gradually pay bigger and bigger debts creating a snowball effect. As you clear each debt, you move on to the next one, gradually addressing larger balances.

- The remaining 1 percent of the Profit Hold Account can be used for a personal treat, such as buying yourself a special coffee.

Business Profitability and Growth

Question 7: Since the Profit, Owner’s Comp, and Tax accounts are all for the benefit of the business owner, they can be combined into one account.

- True

- False

Answer: B – False

The Profit, Owner’s Comp, and Tax accounts cannot be combined into one account, because each bank account has distinct purposes important to have more clarity in the business’ finances. Business owners should NOT use their business as their personal piggy bank because it undermines the true profitability of your business and the businesses valuation.

Here are the different types of accounts that benefit business owner(s):

- Profit Hold Account: After paying debt and allocating money on other important expenses. Business owners are going to take 50% of the owner’s distribution to keep for themselves to do whatever they want, and the other 50% will go to the Profit Hold account that will serve as a cushion in the business giving the business owner security.

- Owner’s Compensation (Owner’s Pay) Accout: This account is designated for the salary business owners use to cover personal living expenses. This account should be separate for entrepreneurs to ensure they meet their basic needs without using other funds intended for different purposes.

- Tax Hold Account: The Tax account sets aside funds for tax obligations, both quarterly estimates and payroll taxes. Keeping it distinct prevents any confusion during tax time.

Computing the Right Amount of Allocations

Question 8: Let’s say a small construction business has $500,000 in total revenue. They spend $180,000 on materials used in their projects. And they also pay their subcontractors a total of $75,000 for the year. Additionally, they pay an office manager $40,000 per year, and the rent for their main office is $12,000 per year. If the business is using the target allocation percentages for their real revenue level, which of the following allocations are correct?

- Profit: $24,500, Owner’s Comp: $250, 000, Tax: $26,750, OpEx: $73,500.

- Profit: $50,000, Owner’s Comp: $175,000, Tax: $75,000, OpEx: $200,000.

- Profit: $12,250, Owner’s Comp: $122,500, Tax: $36,750, OpEx: $73,500.

Answer: C – Profit: $12,250, Owner’s Comp: $122,500, Tax: $36,750, OpEx: $73,500

Let’s break down the calculation for you to understand why that is the answer.

Step 1: Calculate the Real Revenue

- Total Revenue: $500,000

- Minus Materials: $180,000

- Minus Subcontractors: $75,000

Real Revenue = $500,000 – $180,000 – $75,000 = $245,000

Step 2: Determine Target Allocation Percentages (TAPs):

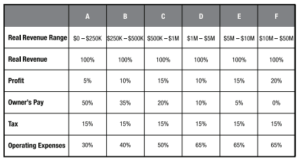

To determine the percentage for each allocation, check the Allocation Percentage Chart. Since the real revenue in the problem is $245,000, it falls in column A, which means that the profit is 5%, the owner’s pay is 50%x the tax is 15%, and the operating expenses are 30%.

Step 3: Calculate the Allocations based on the Percentage

- Profit: 5% of $245,000 = $12,250

- Owner’s Comp: 50% of $245,000 = $122,500

- Tax: 15% of $245,000 = $36,750

- OpEx: 30% of $245,000 = $73,500

Difference Between Profit and Owner’s Comp

Question 9: Not all business owners are on the company’s payroll. Many take their compensation in the form of draws and distributions from the business. Do these business owners need separate Profit and Owner’s Comp accounts?

- Yes. Owner’s Comp acts as a regular payroll to the owners and supports the owner’s lifestyle. Profit acts like a bonus.

- No. In this case, you can combine the Profit and Owner’s Comp accounts.

- Yes, but both Owner’s Comp and the Profit distribution support the owner’s lifestyle.

Answer: A – Yes. Owner’s Comp acts as a regular payroll to the owners and supports the owner’s lifestyle. Profit acts like a bonus

If business owners take their compensation in the form of draws and distributions, it’s crucial to maintain separate Owner’s Comp and Profit accounts. The Owner’s Comp account serves as regular payroll, supporting the owner’s ongoing lifestyle expenses. On the other hand, the Profit account functions like a bonus, a reward for successfully running the business. Combining these accounts might lead to the misuse of business funds and treating the business like a personal piggy bank.

When to Implement Profit First in Business

Question 10: My business is just getting started, and I’m not showing a profit yet. I need to wait until I’m profitable to implement Profit First in my business.

- True

- False

Answer: B – False

You don’t need to wait until your business is profitable to implement Profit First. Even if your business is just getting started and hasn’t shown a profit yet, it’s advisable to begin implementing Profit First as soon as possible. If you’re in operations, have expenses, and some money is coming in, the system can be implemented.

For very new businesses that haven’t met their targeted sales, you can start with the target allocation percentages from the beginning. However, for businesses that have been operating for a few months with some revenue and expenses, it’s crucial to conduct an instant assessment to help you understand the current financial situation of your business and set up a proper roll-out plan.

Final Thoughts

The sooner you implement Profit First in your business, the better so you can start your journey to achieving permanent profitability early. It is important to understand the basic and key concepts of handling your finances in your business to ensure that you are allocating the right amount of money in the right place. Always remember to have separate bank accounts, it may seem tedious to manage many different bank accounts at the same time, but it will definitely make it easier for your business’ finances to thrive with them.

Stay tuned to watch our upcoming episodes. Profit First is here to guide you in your business and will help you in your journey to profitability.

Profit Nation

Co-HostDanielle Mulvey is your Certified Profit First Mastery "Podcast Guide" and Mike Michalowicz is the author of Profit First. Both Danielle and Mike were members of YEO before they had to drop the "Y" and part of Birthing of Giants at MIT when they were both in their 20's....that gives them a combined 50 years of entrepreneurial experience and counting.